Apple's Balance Sheet Health?

Warren Buffett once said that volatility doesn't necessarily mean risk. This means that debt is a crucial factor to consider when assessing a company's risk level, especially since it's usually involved in bankruptcies. Apple, like many other companies, utilizes debt. But does this debt pose a risk to its shareholders?

Is Debt A Danger?

Debt is a problem when a company can't pay it off with its own money or by raising capital. If a company can't pay its creditors it can go bankrupt. They may have to raise new equity capital at a low price, hurting shareholders. But debt can also be good because it can be cheap capital. We look at both cash and debt levels when examining a company's debt.

Check out our new study on Apple We have just released our analysis on Apple Take a look at our latest report about Apple

Apple's Net Debt: A Brief Explanation

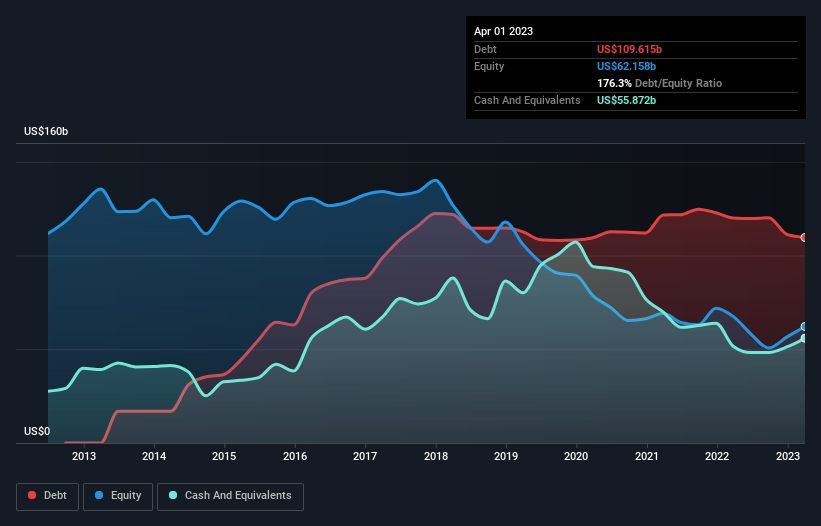

Apple's debt decreased from US$120.0b to US$109.6b by April 2023. If you click on the image, you can see the details. Despite this, they also hold US$55.9b in cash. Therefore, net debt is US$53.7b.

Apple owes US$120.1b that must be paid in the next year. They owe US$149.9b after that. They have US$55.9b in cash and US$35.9b in receivables due in the next 12 months. But, their debt is US$178.2b more than their cash and short-term receivables.

Apple's public shares are worth US$2.79t, which is a lot. So, it doesn't seem like they'll be in trouble with their liabilities. But, we should still watch their balance sheet strength. It might change in the future.

To figure out how much debt a company can handle, we compare its net debt to its EBITDA. We also check if its EBIT can cover its interest expense. This way, we look at the amount of debt and the interest rates.

Apple's net debt to EBITDA ratio is low at 0.43. The company easily covers interest expenses, with EBIT being 515 times the size. There's no need to worry about Apple's conservative debt use. But, there's been a 5.9% decline in EBIT in the last twelve months, making debt harder to handle. Examining the balance sheet is important when analyzing debt. Future profitability will determine if Apple can improve its balance sheet. Check out the free report on analyst profit forecasts to see what the experts think.

Companies need cash to pay off debt, not just profits on paper. We look at how much of their profits turn into actual cash. Apple did a great job with this in the past three years. Their free cash flow was worth almost all of their profits, which is better than most companies. This means they have enough money to pay off debt if they want to.

Apple's ability to pay its debts with its earnings impresses us. However, its earnings growth rate makes us a bit cautious. Overall, we think Apple's use of debt is reasonable. Debt can bring risks, but it can also bring more profit. When checking debt levels, we start with the balance sheet, but there may be hidden risks. We found 1 warning sign for Apple that you should know about.

In conclusion, it's best to target firms without debt. We have a list of these companies, which have consistently made profits. The list is free to access.

Do you have feedback on this article? Are you concerned about the content? You can contact us directly. You can also email editorial-team (at) simplywallst.com.

Simply Wall St's article is a general one. We comment based on past data and analyst forecasts. We use an unbiased method and don't offer financial advice. We do not suggest buying or selling stocks without considering individual goals and finances. Our focus is on long-term analysis based on fundamental data. We may not include recent company announcements or qualitative information in our analysis. Simply Wall St does not hold any positions in the mentioned stocks.

Participate in a Paid User Research Session. Help us improve our investment tools for individuals like you. Get a US$30 Amazon gift card for one hour of your time. Register now!