China Vows More Economic Support as Recovery Continues to Wane

China's manufacturing and real estate sectors experienced a further decline in July, compelling the Beijing government to make new commitments to bolster the country's economic resurgence.

Top Stories on Bloomberg that Sparked Interest

The United States and Europe are becoming increasingly concerned about China's rapid entry into the market for outdated semiconductor chips.

A group associated with Charles Koch attempts to prevent Trump from obtaining the Republican Party's nomination.

The pursuit of highly profitable finance positions escalates with the backing of the wealthiest families in Asia.

Myanmar Military Rulers Grant Amnesty to Aung San Suu Kyi on Certain Accusations

Prime Minister of Singapore to Speak on Political Affairs in Parliament The leader of Singapore, the Prime Minister, is set to discuss matters pertaining to political controversies during a session of the country's Parliament.

Last month, the Caixin manufacturing activity index dropped to its lowest level in six months, standing at 49.2. This indicates a decline in the sector as there was a significant decrease in export demand. Additionally, a different report revealed that home sales experienced a sharp decline of 33.1% in July, marking the largest decrease in a year.

The dismal economic statistics coincided with a flurry of commitments made by the governing authorities in the past few days to strengthen the economy. These commitments align with the pro-growth indications expressed by the Politburo, the highest decision-making entity of the Communist Party, last week.

On Tuesday, the leading economic planner in China, the National Development and Reform Commission, announced that the government plans to increase lending to private enterprises and provide additional financial assistance to small businesses. Furthermore, the Ministry of Industry and Information Technology, in collaboration with four other governmental organizations including the central bank, committed to enhancing financial support to smaller companies that are crucial in supply chains.

On Tuesday, the People's Bank of China and State Administration of Foreign Exchange issued a statement announcing their intention to guide banks in reducing current mortgage rates. They also expressed their commitment to continue supporting the steady growth of the real estate market.

The blog post states that there will be a decrease in both mortgage interest rates and down payment ratios in order to satisfy the demand. The joint statement also mentions that the central bank will continue to enforce a careful and powerful monetary policy.

Leading officials issued a statement on Monday urging cities to implement measures that promote the sustainable growth of their real estate sectors.

Despite investors feeling optimistic about the positive indications thus far, stocks experienced a downturn on Tuesday due to lackluster economic data. Experts have highlighted that Beijing has chosen not to implement substantial monetary and fiscal stimuli. Additionally, the policy measures that have been announced fail to include any direct provision of cash assistance to consumers in order to boost spending.

Ding Shuang, the chief economist for Greater China and North Asia at Standard Chartered Plc, expressed that the danger lies in having an excessively lengthy list, leading to the essential measures being weakened. He was referring to the notice from the NDRC. Ding emphasized that implementing these measures is crucial for gradually restoring confidence, but it will require a considerable amount of time.

"He stated that the crucial focus is creating an atmosphere that encourages private enterprises to confidently invest, with transparent and equitable regulations applicable to everyone involved," he remarked.

The announcement made on Tuesday by the MIIT and other government agencies committed to establishing a compilation of lesser-sized enterprises involved in crucial supply networks, determining their financial requirements, and urging banks to assist them. These companies will receive assistance in order to become publicly traded, and there will be incentives for private equity firms to invest in them, as stated in the announcement.

On Tuesday, officials from the NDRC emphasized their backing for the robust growth of internet platform companies and pledged to announce additional investment initiatives by these companies.

Authorities in the past few days have additionally released strategies to enhance consumer sectors. They announced on Friday their desire to amplify the consumer goods industry, known as light industry. This sector encompasses a diverse range of products such as household items, food and paper production, plastic goods, leather products, and batteries.

The analysis provided by Bloomberg Economics...

China's administration is following through on its promise to assist the economy by implementing a range of fresh measures to stimulate spending and bolster the real estate sector. These actions enhance the probability of a stronger rebound in the second half of the year, yet the overall risks remain tilted towards a decline. We believe that additional steps are likely necessary to counteract the negative effect of the struggling housing market and the lack of confidence among businesses and consumers.

Chang Shu, primary Asian economist

To access the complete report, please click here.

The Caixin indicator emerged one day after the official index regarding purchasing managers revealed a decline in manufacturing during the month of July, along with a decrease in services activity. In addition, various recent indicators repeating at a high frequency also demonstrated a restrained level of consumer expenditure throughout the same period.

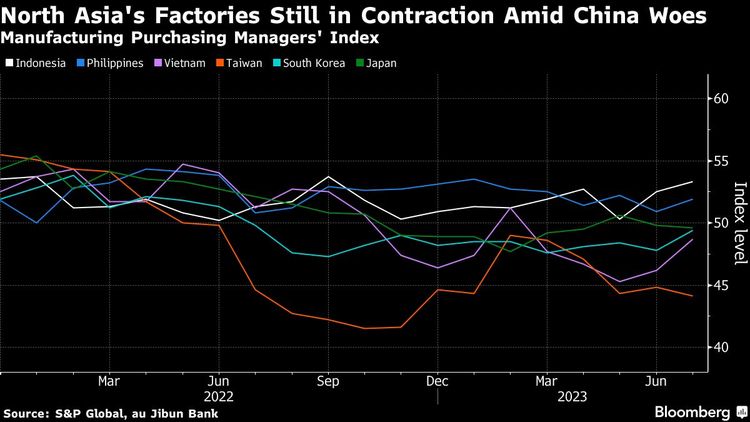

The decline in Chinese manufacturing is having a negative impact on factories in Asia. In July, Taiwan's purchasing managers index reached its lowest point in eight months, dropping to 44.1. Similarly, Japan's index slightly decreased to 49.6, as reported by S&P Global and au Jibun Bank on Tuesday. Fortunately, the domestic demand in Southeast Asian countries like Indonesia and the Philippines provided some protection against this downturn.

Thanks to the help of Claire Jiao, Karthikeyan Sundaram, Evelyn Yu, and Philip Glamann.

(Upgrades with declaration from the People's Bank of China and State Administration of Foreign Exchange.)

Top Stories on Bloomberg Businessweek

Influential individuals played a significant role in establishing this wellness startup—until their health began to deteriorate.

The Role of Artificial Intelligence in the Entertainment Industry Has Evolved from a Negotiation Obstacle to a Profound Dilemma

The Rising Popularity of Stainless Steel Is Causing Discord within a Mining Area in South Africa

Predicting the Future of China's Property Market in Half a Decade

The Transformation of a Country Estate Inspires an Entrepreneurial Journey into the World of Hospitality Décor